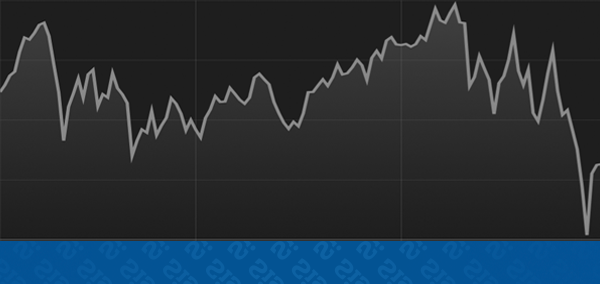

A decade of consecutive positive annual returns from the S&P 500 ended in 2018. In the final three months of the year, the S&P 500 registered its worst quarterly performance in seven years and ended 2018 with a negative annual total return for the first time since 2008.

Contrary to most of the headlines we saw during the last three months, the sharp declines in stocks weren’t directly driven by trade wars or ongoing political dramas, all of which were with us for the majority of 2018. Instead, the break down in stocks was driven by a trifecta of classic economic and market concerns emanating from underwhelming corporate earnings guidance, suddenly lackluster economic growth and disappointment towards Federal Reserve monetary policy.

Stocks initially dropped in early October as the third-quarter corporate earnings season disappointed markets. While most companies beat consensus estimates, as they often do, profit warnings from select multinational and industrial firms such as PPG Industries (PPG) and FedEx (FDX) highlighted growing concerns from analysts about peak earnings growth for U.S. corporations. That rising concern was reflected by the market’s performance during the heart of the third-quarter reporting season, as the S&P 500 declined 6.84% in October.

After a respite from selling in November that saw stocks bounce back slightly from the October losses, earnings concerns were compounded in December by suddenly disappointing economic readings. In early December, multiple economic indicators including manufacturing surveys and the November jobs report missed Wall Street consensus estimates, adding the potential of slowing economic growth to the list of headwinds on stocks.

Finally, uncertainty regarding U.S. monetary policy in the wake of the December rate hike by the Federal Reserve added yet another source of concern for investors, and that additional unknown caused a massive spike in market volatility in late December. Specifically, the Fed increased interest rates for the fourth time in 2018, despite the declines in stocks and wavering economic data, and signaled it expects to increase rates two more times in 2019. That policy decision, which was more restrictive than investors were hoping for, caused stocks to plunge as the major equity indexes dropped to fresh 52-week lows during the final two weeks of December. Markets did bounce modestly during the final days of 2018 to finish off the worst levels of the year, but still solidly negative on an annual basis.

Despite the legitimate concerns about economic growth, earnings and Fed policy, the news in the fourth quarter wasn’t all bad.

First, the U.S. and China agreed to a temporary trade war “truce” and began an intense, 90-day negotiation period aimed at ending the trade war.

Second, the European Union and the Italian government reached a compromise on Italy’s proposed 2019 budget that satisfied European Commission rules, thereby avoiding a political showdown.

Lastly, most major indicators of U.S. economic growth, while exhibiting a loss of momentum, remained in solidly positive territory, meaning the economy is still growing (albeit, potentially at a slower pace). The November Employment Situation Report showed positive jobs growth and an unemployment rate under 4% while regional manufacturing surveys remained in positive territory.

In sum, 2018 was a very difficult year in the markets and for investors. Not only did most major stock indices post a negative full-year total return for the first time since 2008, but the declines came with two episodes of intense, confidence-shaking volatility in the first and fourth quarters.

But, it’s important to remember that while volatile markets can and will occur, just like they did most recently in 2011 and 2015, the fundamental drivers of the multi-year rise in stocks remain generally in place, and that’s important context to remember as we begin a new quarter and calendar year.

1st Quarter and 2019 Market Outlook

Investors begin 2019 reeling from the worst quarter in years and with

markets facing multiple headwinds including an uncertain outlook for

corporate earnings, potentially slowing economic growth, and a lack of

clarity on Fed policy. Yet, at the same time, these concerns have been

at least partially acknowledged by the markets as the major U.S. stock

indices begin 2019 more than 10% off their 2018 highs, as expectations

for earnings and economic growth have been reduced.

At a minimum, we can expect continued volatility in stock, bond and

commodity markets in the coming months. And, whether the markets

continue the fourth-quarter declines or rebound will depend largely on

the resolution of those three uncertainties facing markets: Earnings,

economic growth and Fed policy.

Regarding earnings, the bulk of the fourth-quarter 2018 earnings results

will be released this month, so within the next few weeks we should

learn whether U.S. corporate results have stabilized, or whether the

disappointing guidance we saw from companies in Q3 continued.

Economically, investors will be focused on widely followed economic

reports (including the December Employment Situation Report, ISM

Manufacturing PMI, Retail Sales, Core PCE Price Index) to determine

whether U.S. economic growth has indeed peaked.

From a Fed policy standpoint, the next Fed meeting occurs at the end of

January, but there’s an important change in Fed procedure to consider in

2019. Fed Chair Jerome Powell will hold a press conference after each

meeting in 2019 (the change was announced well before the recent market

volatility). That additional, regular communication should afford the

chairman the opportunity to communicate more effectively with investors

and potentially resolve uncertainty regarding Fed policy.

Finally, we begin 2019 with numerous geopolitical situations to watch.

First, the U.S.-China trade talks are ongoing and there remains hope

that the two sides will reach an agreement to reduce existing tariffs

before the 90-day negotiation period expires. In Europe, Brexit remains

unsettled, although negotiations among Britain’s largest political

parties continues in an effort to approve the Brexit agreement with

Europe.

Bottom line, this is an environment that requires vigilance and

heightened focus on financial market moves, economic news and political

developments.

However, while we can expect volatility to continue, especially early in

2019, it’s important to remember that the last two episodes of similar

volatility (2011 and 2015) proved to be long-term buying opportunities.

Past performance is not indicative of future results, but history has

shown that a long-term approach combined with a well-designed and

well-executed investment strategy can overcome periods of heightened

volatility, market corrections, and even bear markets.

At Sisto Investment Advisory, LLC, we understand the risks facing both

the markets and the economy, and we are committed to helping you

effectively navigate this challenging investment environment. Successful

investing is a marathon, not a sprint, and even intense volatility like

we experienced in the fourth quarter is unlikely to alter a diversified

approach set up to meet your long-term investment goals.

Therefore, it’s critical for you to stay invested, remain patient, and

stick to the plan. We’ve worked with you to establish a personal

allocation target based on your financial position, risk tolerance, and

investment timeline. Therefore, we aim to take a diversified and

disciplined approach with a clear focus on longer-term goals.

We understand that volatile markets are both unnerving and stressful,

and we thank you for your ongoing confidence and trust. Rest assured

that our entire team will remain dedicated to helping you successfully

navigate this difficult market environment.

Please do not hesitate to contact us with any questions, comments, or to schedule a portfolio review.

Sincerely,