The IRS and California FTB have announced the postponement of tax filing and payment deadlines to October 16, 2023, for taxpayers located in all California counties except Modoc, Shasta, Lassen, Plumas, Sierra, Kern & Imperial (see map attached).

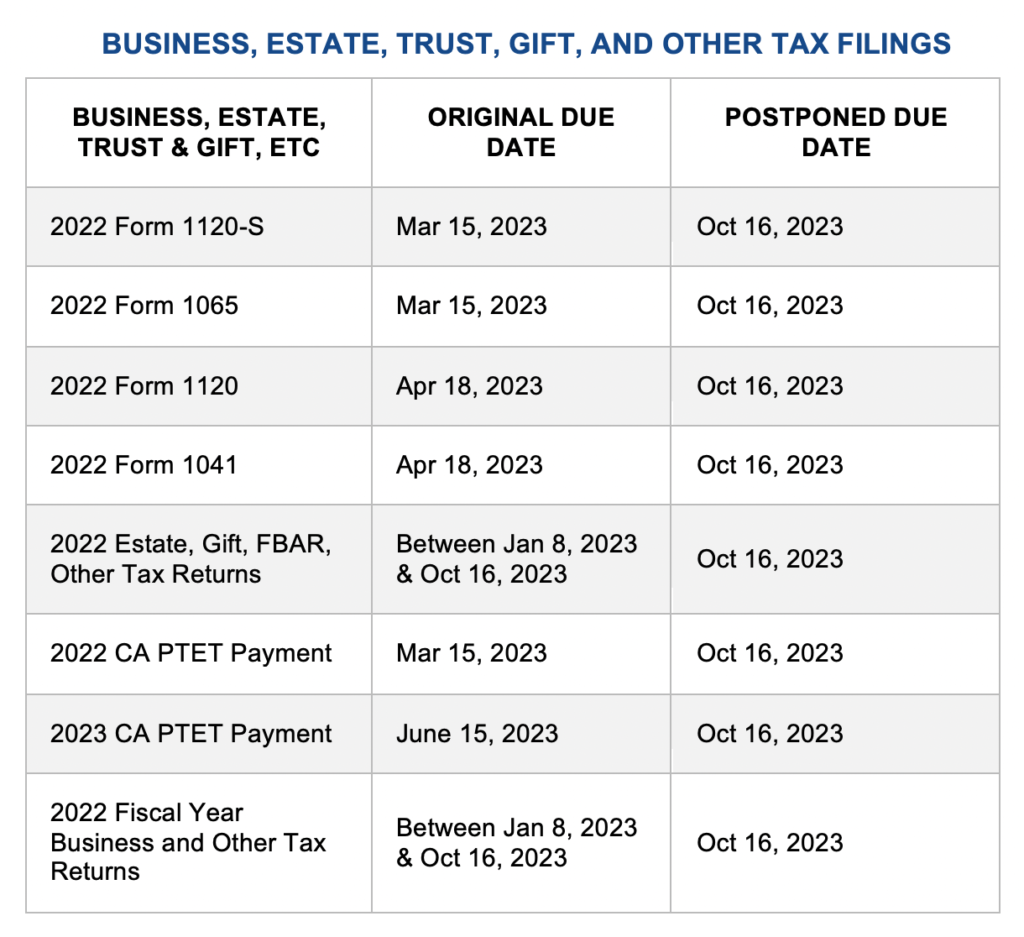

The extended date applies to all returns due prior to the October 16, 2023 deadline and applies to any estimated tax payments that are due prior to October 16, including the March 15 and June 15 passthrough entity elective tax payments. This extension applies to the filing of payroll tax returns (excluding W-2’s and Forms 1099) but does not apply to the payment of employment/excise tax deposits.

Relief is automatic. Taxpayers may receive notices assessing penalties for postponing, however, these penalties can be abated by contacting the IRS.

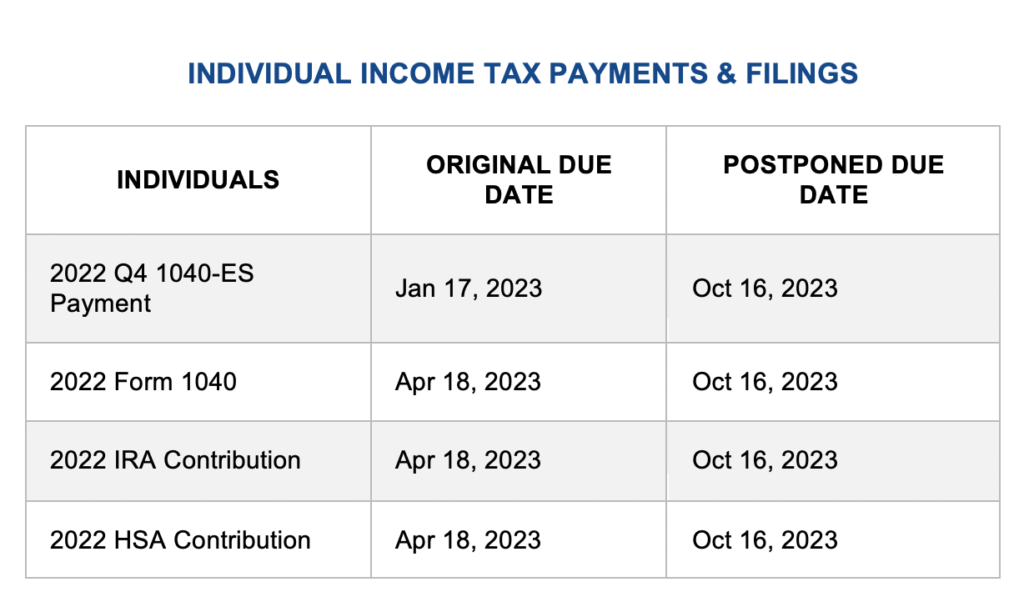

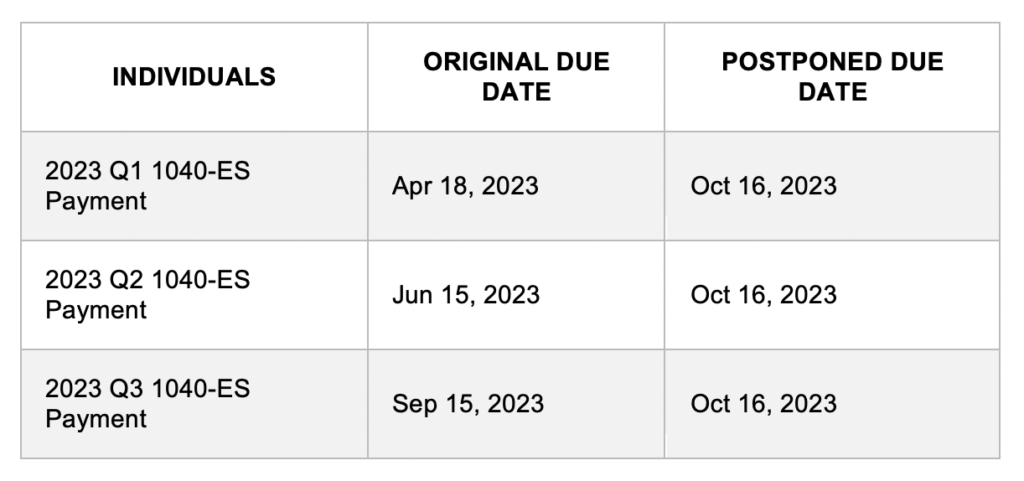

The following charts show the new postponed deadlines for 2022 individual, business, and miscellaneous other tax filings: